Guided Investing

This is how easy online investing can be

- You can start with € 20

- ABN AMRO experts manage your fund

- Get started within 10 minutes

Arranging your investments in a few simple steps

If you’re interested in investing, but find getting started too difficult or time-consuming, Guided Investing could be the answer. You can start investing in one of the ABN AMRO Profile Funds from as little as € 20. The online guidance helps you make the right choices to get started. After that, our fund managers will take over.

How Guided Investing works

1. Open your account

It takes just 10 minutes to open an account. Our online guidance will then start.

2. Select your profile fund

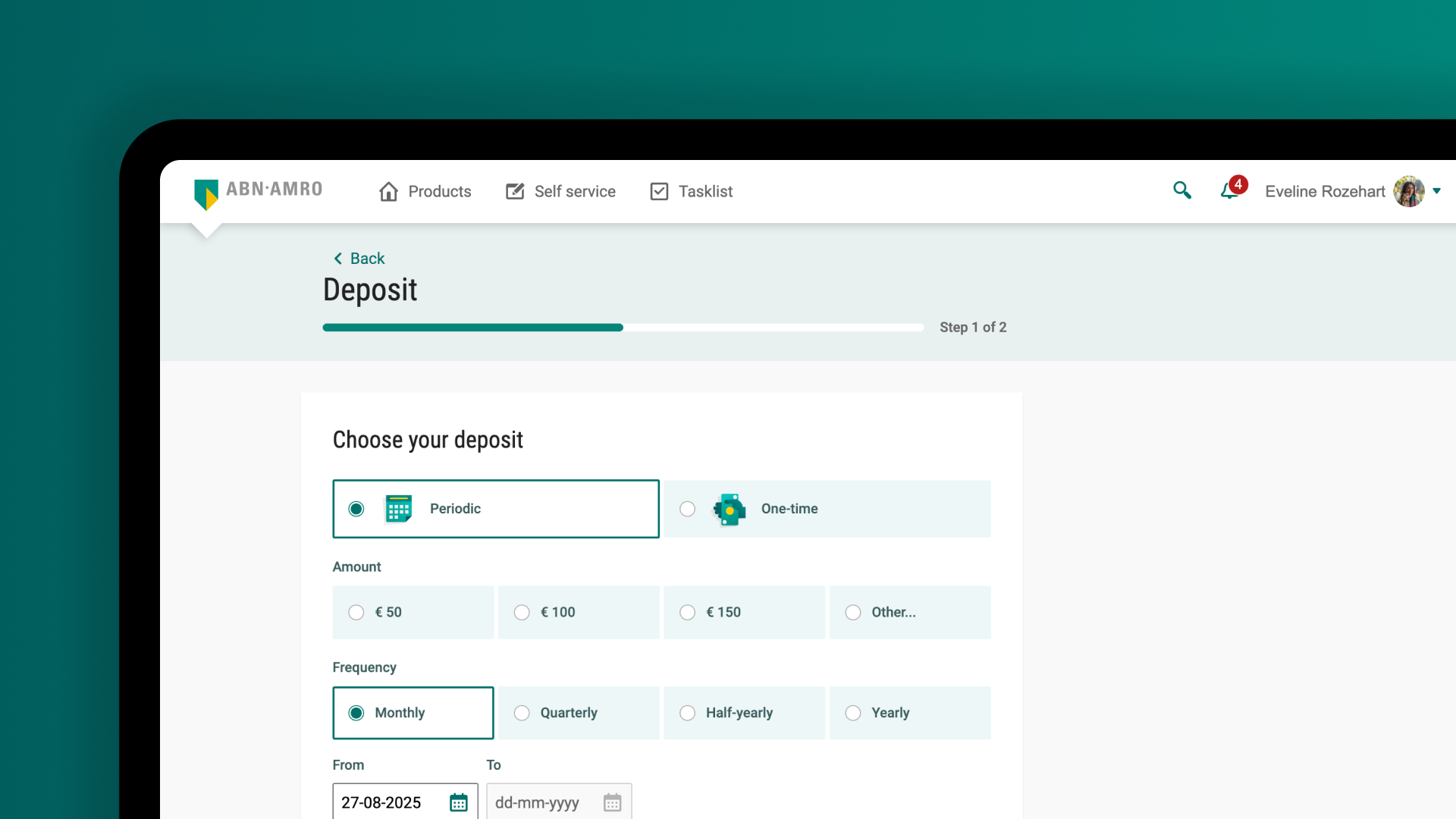

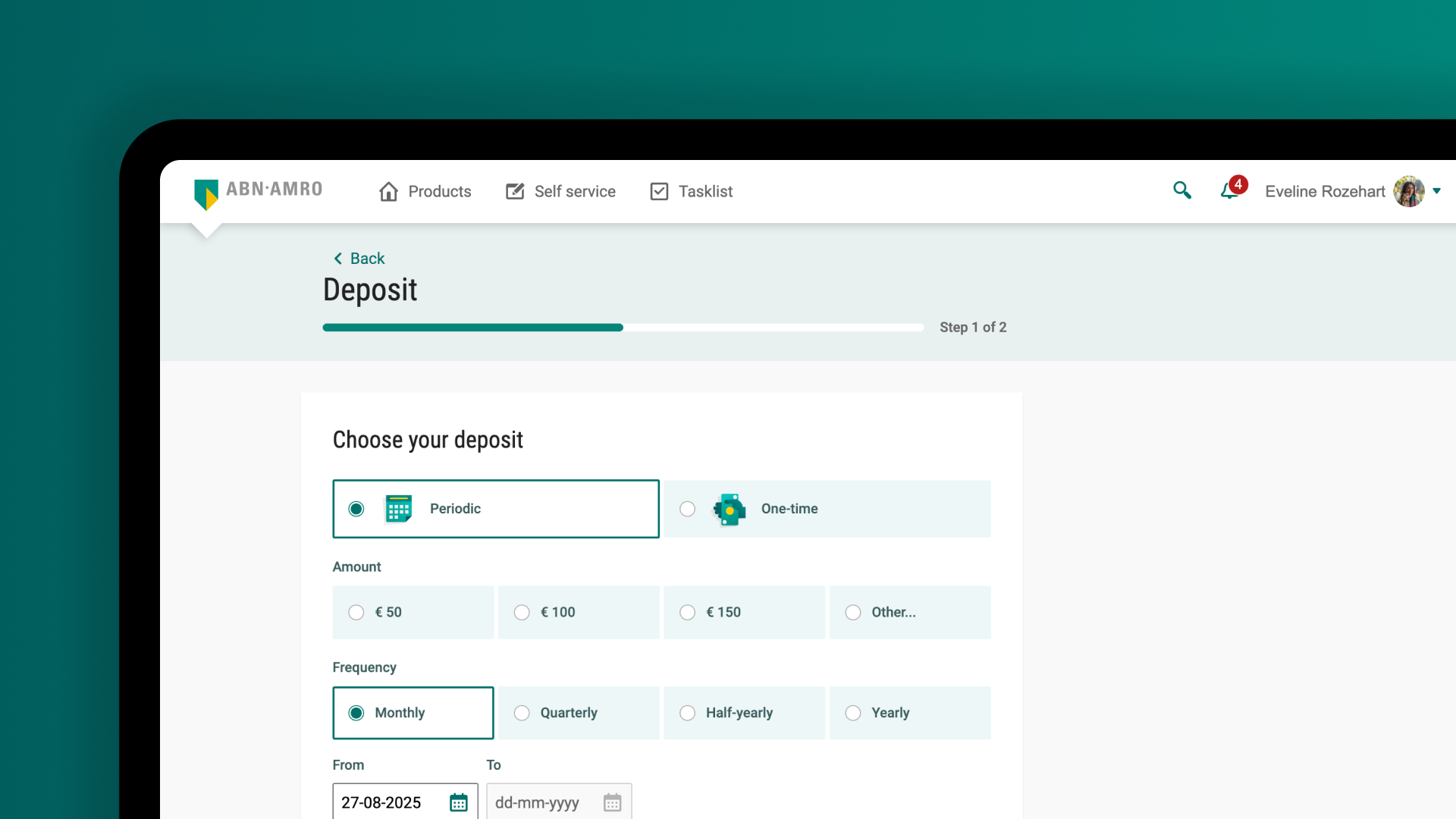

We will suggest two ABN AMRO Profile Funds that suit your target, risk profile and investment period. Make your choice, so that you can invest in the fund either with a one-off deposit or periodically.

3. We get to work

Our experts will manage your ABN AMRO Profile Fund. They are constantly looking for the best return within your risk limits. You can view your account 24/7 in the ABN AMRO app or on Internet Banking.

Bonus of up to €100 when you invest

Thinking about investing? Start with us this winter and get a bonus. Open your first investment account before 31 March 2026 and make 4 automatic investments. If you satisfy the promotion terms and conditions, you’ll earn a bonus of €50, €75 or €100. Please note: you could lose all or part of your initial investment.

Our cumulative results

This graph shows you what your return would have been, if you had, for example, made a one-off investment of €1,000 in one of the five funds on 1 January 2020.

Source: ABN AMRO Investment Solutions, Morningstar. Compound return from 01/01/2020 to 31/12/2024, in euros and after deduction of fees. Net dividends reinvested (if applicable). Based on a geometrical calculation method. The value of your investments can vary. Past results are not indicative of future results.

Prize-winning investments with ABN AMRO

Investing with ABN AMRO means investing with over 200 years’ experience. Our expertise, service and products are distinctive and receive great ratings. So great in fact, that we regularly win prizes.

Investing and risks

Investing involves risks. You could lose (some of) the money you invested. Invest with money you have left over, in addition to your buffer for unforeseen expenses.

More information and terms & conditions

Risks

You should only invest capital that you have over and above your buffer for unforeseen expenses. Investing can be interesting, but it is not without risk. You can lose (a part of) your deposit. Invest only in investment products that you understand.

With Guided Investing you make your own choices - without advice from us - and thus determine your own risk limits. We have listed the most common investment risks for you.

Who is Guided Investing for?

Guided Investing is for you if:

Who is Guided Investing for?

- You have money left over and are looking for opportunities to invest

- You want to invest independently and with ease

- You want to have an option to invest periodically

- You want to start investing from as little as € 20

- You have a long-term investment horizon but you want to be sure that you can sell at any time

- You want to invest in an ABN AMRO Profile Fund managed by a team of experts.

- You know that investing carries risks and you could lose (part of) your deposit

If you are (or are investing on behalf of) a minor, a foundation, an association or a client who is under judicial administration, different rules apply, but you can still invest through Guided Investing.

How much does Guided Investing cost?

This is how the costs are divided:

Service fees

You pay a fixed percentage as the service fee for Guided Investing. This fee includes:

- costs of buying and selling

- costs for online support

- costs for administering your Profile Fund

- costs for providing the information you need.

The service fees are 0.25% per annum based on the value of your investments. We charge these fees quarterly (every 3 months). At the end of each quarter, we determine the value of the investments. If you have no investments in a fund, you do not pay service fees.

Product costs

You pay costs incurred by an investment fund. These costs consist of ongoing charges and transaction costs within the fund.

Ongoing costs

The ongoing costs are always shown as a percentage of the fund assets. You can also find the ongoing costs in the Key Investor Information Document (EBI) of the Profile Funds.

Transaction costs

The transaction costs are the costs incurred by the Profile Fund when buying or selling investments. The ongoing costs include, amongst others, the costs for managing, servicing and administering the investment fund.

Additional information

The ‘Additional information relating to the costs’ information sheet explains about different types of fees. Not all sections of the document are relevant for Guided Investing, the section ‘Investment Funds’ is particularly relevant to Guided Investing.

Returns ABN AMRO Profile Funds

There are 5 ABN AMRO Profile Funds managed by an experienced fund manager. Every fund has its own characteristics and different risks.

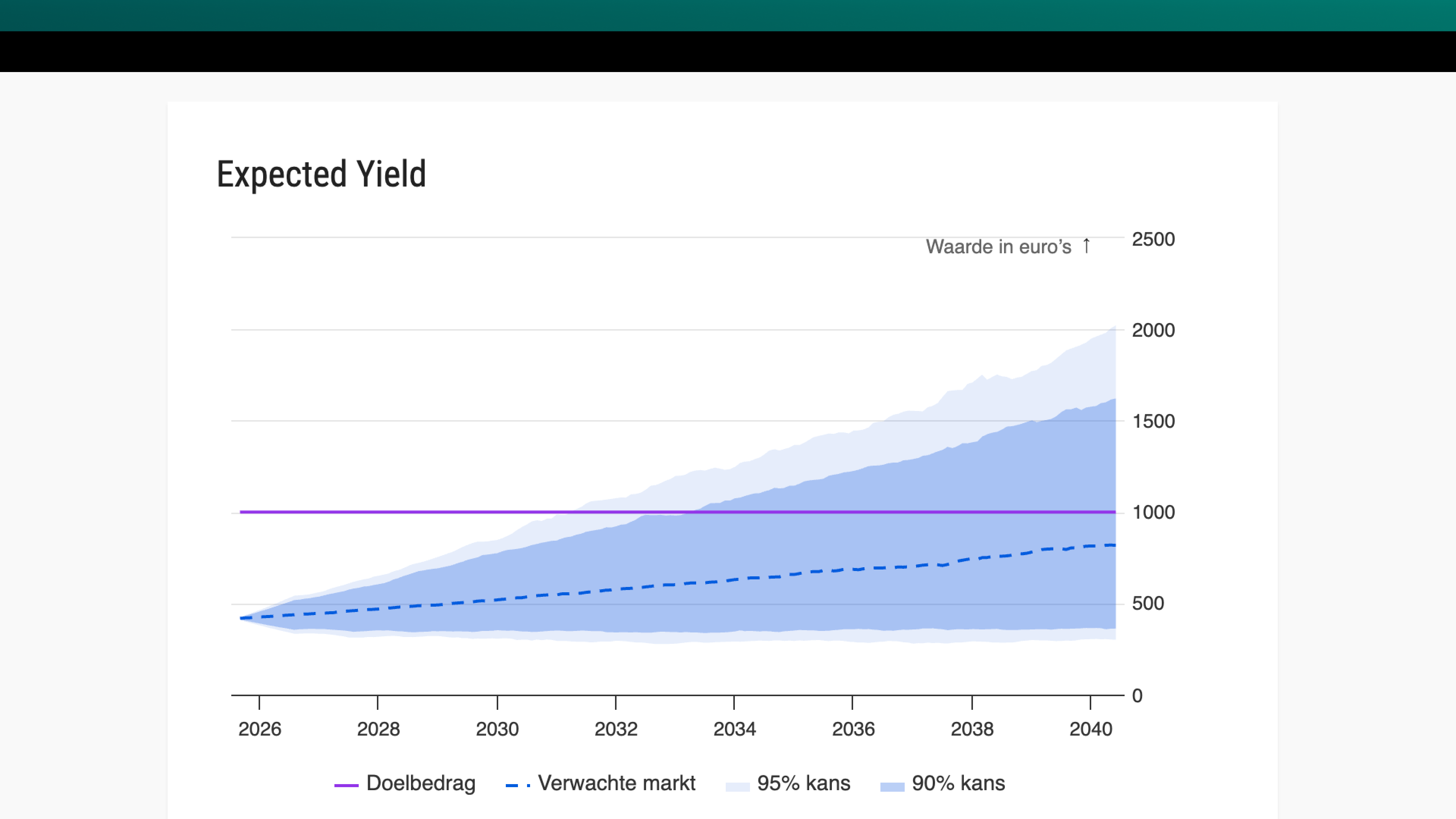

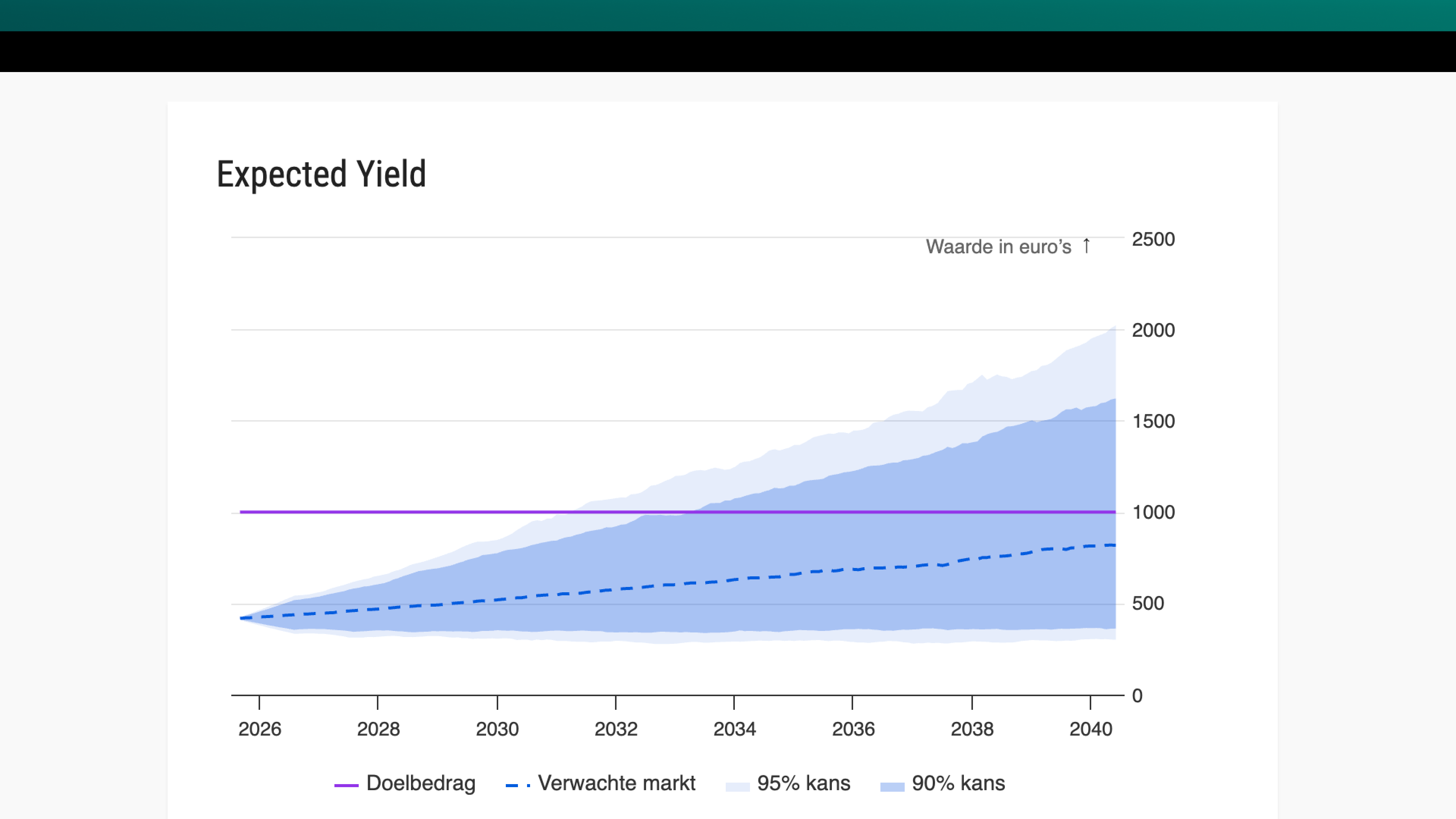

Track your investments via the app or Internet Banking.

You always have insight into your portfolio through the ABN AMRO app and Internet Banking.

Here:

- You can see the development and current value of your ABN AMRO Profile Fund;

- You also have direct insight into the achievement of the target amount under different market conditions;

- You make your deposits;

- You change the choices for your target amount, term, and profile fund.

Making a deposit or withdrawal

You can buy or sell an ABN AMRO Profile Fund at any time via the Mobile Banking app or Internet Banking. There are no transaction costs involved. You can also place a periodic order, meaning that you automatically make a periodic deposit. It is very simple and easy.

In placing your order, you are buying or selling part of the ABN AMRO Profile Fund. This process takes a maximum of 4 working days.

Stop investing

You can stop your Guided Investing at any time. You can cancel in writing or notify us online that you want us to close your account. You can sell your investment in your ABN AMRO Profile Fund free of charge.

ESG Investing

ABN AMRO Profile Funds take ESG into account. ESG stands for Environment, Social, and Governance. We select companies and governments that perform well in these three areas. This means certain investments are not allowed, such as in companies that produce controversial weapons or tobacco products. At least 90% of the portfolio is selected based on these criteria.

Furthermore, the fund is committed to take engagement actions when necessary.

Risks

You should only invest capital that you have over and above your buffer for unforeseen expenses. Investing can be interesting, but it is not without risk. You can lose (a part of) your deposit. Invest only in investment products that you understand.

With Guided Investing you make your own choices - without advice from us - and thus determine your own risk limits. We have listed the most common investment risks for you.

Who is Guided Investing for?

Guided Investing is for you if:

Who is Guided Investing for?

- You have money left over and are looking for opportunities to invest

- You want to invest independently and with ease

- You want to have an option to invest periodically

- You want to start investing from as little as € 20

- You have a long-term investment horizon but you want to be sure that you can sell at any time

- You want to invest in an ABN AMRO Profile Fund managed by a team of experts.

- You know that investing carries risks and you could lose (part of) your deposit

If you are (or are investing on behalf of) a minor, a foundation, an association or a client who is under judicial administration, different rules apply, but you can still invest through Guided Investing.

How much does Guided Investing cost?

This is how the costs are divided:

Service fees

You pay a fixed percentage as the service fee for Guided Investing. This fee includes:

- costs of buying and selling

- costs for online support

- costs for administering your Profile Fund

- costs for providing the information you need.

The service fees are 0.25% per annum based on the value of your investments. We charge these fees quarterly (every 3 months). At the end of each quarter, we determine the value of the investments. If you have no investments in a fund, you do not pay service fees.

Product costs

You pay costs incurred by an investment fund. These costs consist of ongoing charges and transaction costs within the fund.

Ongoing costs

The ongoing costs are always shown as a percentage of the fund assets. You can also find the ongoing costs in the Key Investor Information Document (EBI) of the Profile Funds.

Transaction costs

The transaction costs are the costs incurred by the Profile Fund when buying or selling investments. The ongoing costs include, amongst others, the costs for managing, servicing and administering the investment fund.

Additional information

The ‘Additional information relating to the costs’ information sheet explains about different types of fees. Not all sections of the document are relevant for Guided Investing, the section ‘Investment Funds’ is particularly relevant to Guided Investing.

Returns ABN AMRO Profile Funds

There are 5 ABN AMRO Profile Funds managed by an experienced fund manager. Every fund has its own characteristics and different risks.

Track your investments via the app or Internet Banking.

You always have insight into your portfolio through the ABN AMRO app and Internet Banking.

Here:

- You can see the development and current value of your ABN AMRO Profile Fund;

- You also have direct insight into the achievement of the target amount under different market conditions;

- You make your deposits;

- You change the choices for your target amount, term, and profile fund.

Making a deposit or withdrawal

You can buy or sell an ABN AMRO Profile Fund at any time via the Mobile Banking app or Internet Banking. There are no transaction costs involved. You can also place a periodic order, meaning that you automatically make a periodic deposit. It is very simple and easy.

In placing your order, you are buying or selling part of the ABN AMRO Profile Fund. This process takes a maximum of 4 working days.

Stop investing

You can stop your Guided Investing at any time. You can cancel in writing or notify us online that you want us to close your account. You can sell your investment in your ABN AMRO Profile Fund free of charge.

ESG Investing

ABN AMRO Profile Funds take ESG into account. ESG stands for Environment, Social, and Governance. We select companies and governments that perform well in these three areas. This means certain investments are not allowed, such as in companies that produce controversial weapons or tobacco products. At least 90% of the portfolio is selected based on these criteria.

Furthermore, the fund is committed to take engagement actions when necessary.

Start using Guided Investing

Your own familiar bank

Over 80,000 customers

Available from €20

Investing involves risks

Investing involves risks. You could lose (some of) the money you invested. If you are going to invest, it is important that you are aware of this. Invest with money you can spare. Read more about the risks associated with investments.

Do you need help?

Do you have a question?

Find the answers to frequently asked questions about investing on our service page.